Throughout 2023, the people of Washington State were presented with six opportunities to weigh in on important issues facing the state. These six issues included:

0 Comments

Legislators from the 8th and 9th Legislative Districts will be holding virtual townhall meetings coming up in the next two weeks.

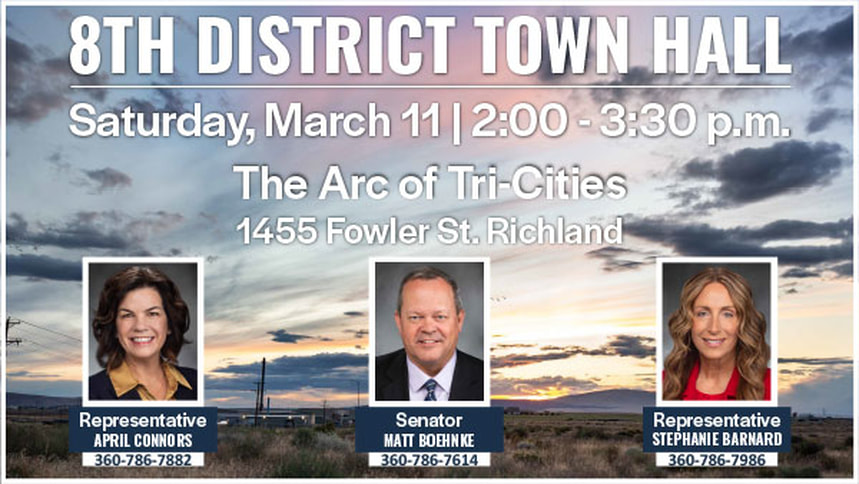

Sen. Matt Boehnke, Rep. Stephanie Barnard, and Rep. April Connors invite the public to attend the virtual event. Residents in the 8th Legislative District will have an opportunity to engage with their state lawmakers. The 8th Legislative District lawmakers will hold their town hall on

These townhall meetings are great opportunities to learn about what is happening in Olympia during this legislative session. Lawmakers are eager to hear from their constituents and rely on them in order to make decisions that relevant to our area. If you aren't sure what Legislative District you are in check out the District Finder. Senators from the Tri-City Region have been busy during the 2024 Legislative Session. We’ve already highlighted a few bills that may emerge from the House of Representative, now we’ll look at a few from the Senate side.  The 8th Legislative District is represented by Senator Matt Boehnke. Senator Boehnke recognizes that tourism is a huge part of the Tri-Cities Regional economy. Sen. Boehnke and Sen Dozier have teamed up to put forth SB 6080 that would make it easier for State tourism funds to automatically be deposited into the State Tourism account.  Senator Mark Schoesler, from the 9th, has been working for the last two years to get a bill passed out of the Senate. SB 5344 would establish a Public-School Revolving fund to issue low-interest or interest-free loans to qualifying school districts for capital projects.  Organized Retail theft is the target of a bill sponsored by Senator Nikki Torres of the 15th Legislative District. Sen. Boehnke and Schoesler have also joined the fight. After two years SB 5160 has made it through the committee gauntlet and is on the Floor Calendar. The bill adds an additional way to commit organized retail theft in the 2nd degree.  Rounding out the Tri-City Regional delegation is Senator Perry Dozier from the 16th Legislative District introduced SB 6238 which would increase assistance amounts for the property tax assistance program for widows and widowers of veterans. Each of these bills have made it out of their committees and are waiting to get placed on the Senate Floor Calendar.

Local lawmaker bills are making progress. Tri-City Regional lawmakers have introduced bills into the 2024 Legislative Session that began on January 8, 2024. Each year hundreds of bills get introduced and many fail to make it past the first gate. The first half of the legislative session is almost over, and local Legislative Representatives are making progress. Here are a few examples.  Representative Stephanie Barnard from the 8th Legislative District recently had success moving HB 2120 out of the House Finance Committee. Her bill would make it possible to allow cities to extend certain tax exemptions for nuclear facilities, to continue research and development in Clean Energy.  Another 8th Legislative District Representative, April Connors, has managed to usher HB 2464 out of the House Committee on Housing. The bill would open additional land within an Urban Growth Area for new manufactured home communities. This bill could assist in alleviating the housing crunch across the state.  Expanding training programs at our state corrections center was the target of Representative Mary Dye, from the 9th Legislative District. A feasibility study authorized by HB 2210 would help determine if a wild horse training, holding and farrier program would fit into the Washington State Correction system.  Representative Mark Klicker from the 16th Legislative District has HB 2428 a bill that would alter the way Cities and Counties can share certain tax revenues. The bill would allow interlocal agreements between local governments or other public agencies to cooperatively conduct government activities.  Fifty five representatives signed on to support Representative Skyler Rude’s HB 1915. Representative Rude’s bill was passed unanimously out of the House Committee on Education. The bill would make financial education instruction a graduation requirement. The bill has strong bipartisan support. Each of these bills will still needs to be passed on the floor of the House before February 13th and go through the Senate process before they will become law. We're headed into the 4th week of the Washington State Legislative Session. Here are the pieces of legislation we're tracking that could impact the business community: Free up 16- and 17-year-olds to participate in CTE on the job trainingThe legislation: House Bill (HB) 2035 Why it matters: Currently youth are not allowed to participate in any work during school hours. Current regulations prevent a high school student from participating in a bona fide career and technical education (CTE) program if it includes work-based learning during the school day. Students can work in these programs if the work falls outside of school hours. This legislation would allow students to work in a bona fide CTE program during the school year and during normal school hours. It also allows students enrolled in a bona fide college program to work the “extended” hours also. What you can do: Send a comment or your position to your legislators. Mandatory payroll deductions for personal retirement accounts The legislation: House Bill (HB) 2244 and Senate Bill (SB) 6069 Why it matters: Studies have shown that many Americans are not preparing for retirement and are relying on Social Security as their retirement plan. The process of setting up a personal IRA account may also be daunting. The House bill and the Senate companion bill would create a mandatory payroll deduction for employees who work for a company that does not currently have some kind of retirement account. The employer must enroll in the program, but the employee must opt out if they don’t want to participate. What you can do: Send a comment on the House bill or comment on the Senate bill. You can also just state your position. Allowing more time clean energy manufacturers to get up and running The legislation: House Bill (HB) 2120 Why it matters: The development of clean energy facilities is a long process. There is currently legislation in place that allows a property tax exemption for up to 5 years on the development of new facilities. That may not be long enough to complete the design and construction. This bill would allow local governments the option to extend the property tax exemption for up to four additional years. This change would allow existing project to be completed and may encourage new projects in clean energy. What you can do: Send a comment or your position to your legislators. New real estate transfer tax could affect affordable housing The legislation: House Bill (HB) 2276 and Senate Bill (SB) 6191 Why it matters: Real estate excise taxes are paid to both the state and local jurisdictions. The state rate is based on a sliding scale depending on the sales price. It goes from 1.1% for sales less that $525,00 up to 3% for sales above $3,025,000. This new law would raise the 1.1% rate up to $750,000 and impose an additional real estate transfer tax (in addition to real estate excise tax) on all sales above the $3,025,000 amount. The new tax could adversely affect the development of new residential housing and multi family dwelling units. The additional tax on multifamily housing would have a negative impact on affordable housing. It could also stymy new commercial construction. What you can do: Send a comment on the House Bill or comment on the Senate Hill. You can also just state your position. Update on last week's bills:House Bill 2114 Rent Control Passed out of Committee and is in House Appropriations Committee Senate Bill 6188 Wind Farm Siting Passed out of Committee and is Senate Environment, Energy & Technology Read last week's Advocacy Update Do you know of legislation that you'd like to see us address? Contact Matt Murphy, Government and Regional Affairs Director, at matt.murphy@tricityregionalchamber.com.

The 2024 Washington State Legislative Session is underway! We're tracking these pieces of legislation that could impact the business community: Gift cards could cost your businessThe legislation: House Bill (HB) 2095 and Senate Bill (SB) 5988 Why it matters: The proposed legislation would require businesses to remit to the State the balance of any unused gift cards if they are not redeemed within three years of purchase. Businesses would still be obligated to honor the cards if they were subsequently redeemed. The business would have to request reimbursement from the State. The proposal would cause a tremendous amount of additional paperwork for businesses in both tracking gift card sales and in requesting reimbursement if the cards are later redeemed. What you can do: Send a comment or your position to your legislators. Linking Washington's carbon market to the California carbon marketThe legislation: HB 2201 and SB 6058 Why it matters: This legislation would open the California Carbon Marketplace up to Washington businesses for the purposes of purchasing carbon credits. It would create a larger marketplace for carbon credits, potentially reducing the cost of carbon credits, which may reduce the pass-through cost to consumers. What you can do: Send a comment or your position to your legislators. Statewide Rent Control The legislation: HB 2114 and SB 5961 Why it matters: The proposed legislation would place a cap on the amount of rent increase during any 12-month period. It would allow a tenant to immediately terminate their lease if a rent increase of 3% was implemented. It also has other limits to fees and restrictions on lease terms. Rent control would eliminate a landlord's ability to recoup expenses resulting from property ownership costs. In the event of a rent increase, landlords could face additional burdens from terminated lease agreements. What you can do: Send a comment or your position to your legislators. Restore local control to wind farm sitingThe legislation: HB 2117 and SB 6188 Why it matters: These bills would require permitting authorities to consider aerial firefighting and wildfire suppression efforts into consideration when siting utility-scale wind facilities. This legislation could limit the size and scope of potential wind farms and provide local jurisdictions more input on siting. What you can do: Send a comment or your position to your legislators. Do you know of legislation that you'd like to see us address? Contact Matt Murphy, Government and Regional Affairs Director, at matt.murphy@tricityregionalchamber.com.

Tri-City Regional Chamber of Commerce Hires Matt Murphy as Government and Regional Affairs Director1/16/2024 The Tri-City Regional Chamber of Commerce (TCRCC) proudly announces the appointment of Matt Murphy as the organization’s Government and Regional Affairs Director. In this pivotal role, Murphy will spearhead the Regional Chamber’s advocacy initiatives, represent the organization on the Tri-Cities Legislative Council, and undertake a variety of other responsibilities.

Before joining the Regional Chamber, Murphy demonstrated exceptional leadership during his nine-year tenure as the President and CEO of the South Kitsap Chamber of Commerce in Port Orchard, WA. His commitment to grassroots advocacy was recognized in 2021 when the Association of Washington Business honored him as the Grassroots Alliance Advocate of the Year. With an extensive background, Murphy has served on influential boards related to his new position, including the Washington Chamber of Commerce Executives Board of Directors, the Olympic Workforce Development Council Board of Directors, and various citizen advisory boards. A Gonzaga University graduate, Murphy also has a military background, having served in the Washington Army National Guard. Lori Mattson, IOM, President and CEO of TCRCC, expressed enthusiasm about Murphy's addition to the Regional Chamber team, stating, “Matt’s previous experience within the chamber of commerce industry and his advocacy for business owners position him perfectly to lead our government affairs efforts.” “I believe collaboration and cooperation are our greatest assets for making change,” said Murphy. “Business, elected officials, and citizens all want the same thing: to make the Tri-Cities a great place to live, work, and play.” Murphy can be reached at 509.491.3234 or matt.murphy@tricityregionalchamber.com. The Horse Heaven Wind Project is under evaluation by the Washington State Energy Facility Site Evaluation Council (EFSEC) who will make a recommendation on the project to Governor Inslee following their next meeting on January 24. TC CARES, a local organization that opposes the project, has started a petition to send to EFSEC prior to their meeting. Why should I sign the petition?

There has been significant concern about the negative impact that this project would have, particularly considering the 231 wind turbines that exceed the height of the Space Needle, spread over such a vast area (a 25-mile corridor encompassing 72,000 acres). Why the Chamber opposes the project: We believe that specific impacts to the Tri-Cities economy and quality-of-life have been inadequately addressed and concerns dismissed as trivial results of necessary clean energy development. The Regional Chamber sent a letter of opposition to the project to Gov. Jay Inslee and EFSEC Chair Kathleen Drew in April 2021. While we refrain from interpreting the science and facts beyond our area of expertise, there remain significant unanswered questions and poorly addressed conclusions. In a 2021 survey, 2,220 respondents and our partners indicated that they had unanswered questions regarding:

Quick links Sen. Matt Boehnke, Rep. April Connors, and Rep. Stephanie Barnard, will host a town hall meeting at The Arc of the Tri-Cities (1455 SE Fowler St. Richland, WA 99352) on Saturday, March 11, from 2:00 - 3:30 p.m.

The 8th District legislative team will answer questions and provide constituents with an update on the 2023 legislative session. Recent Action of Note • HB 1258: Proposed to raise cap on allocation of sales tax dedicated to tourism reinvestment and reduce non-state match to fund utilization. Click here for more information on the bill Last week, Representative Ryu spoke on House Bill 1258 – which focuses on remedying impacts to the tourism industry over the last few years and the merits of raising the cap for retail sales tax dedicated to reinvestment in state tourism activities. In addition to raising the cap allocated from sales tax on tourism activities to the state tourism marketing agency, it would also reduce the 2-to-1 non state fund match on expenditures to 1-to-1. Notable testimony included the quoted $9.5B in economic impact to state and local economies from Washington Wine, and its contributions to tourism. This bill heads to executive session on Wednesday February 8th. Click here to submit public comment Bills to Watch

• HB 1584: Proposed to add ‘Advanced Nuclear Reactor Technology’ to State Energy Strategy considerations for cleaner energy sources. Click here for more information on the bill Testimony will be heard this afternoon (2/7) at 4 p.m. on HB 1584, sponsored by 8th district Representative Stephanie Barnard, regarding the addition of advanced nuclear reactor technology to the State Energy Strategy. 2/7/23 Scheduled for Public Hearing in House Energy and Environment at 4 p.m.; opportunity to comment - Click here to submit public comment • HB 1505: Proposed to create a state alternative jet fuels working group to assess feasibility of manufacturing in Washington and proposing a tax credit for manufacturing meeting certain thresholds. Click here for more information on the bill HB 1505 will also be heard this afternoon (2/7) at 4 p.m. by the House Committee on Environment and Energy regarding the formation of an alternative jet fuels workgroup, and consideration on an Occupation Tax and Public Utility District Tax credit for producers manufacturing minimum quantities of alternative jet fuel and encouraging location of said facilities in counties with populations less than 650,000. 2/7/23 Scheduled for Public Hearing in House Energy and Environment at 4 p.m.; opportunity to comment - Click here to submit public comment |

Categories

All

Archives

May 2024

|

|

Copyright © Tri-City Regional Chamber of Commerce. All rights reserved.

7130 W Grandridge Blvd., Suite C, Kennewick, WA 99336 USA Phone: (509) 736-0510 info@tricityregionalchamber.com |

Hours

Monday - Thursday: 8 am - 5 pm (closed for lunch 12 - 1 pm) Friday: 8 am - 12 pm Closed Weekends |

RSS Feed

RSS Feed